6 Bedroom HMO in Swansea City Centre

6 Bedroom HMO in Swansea City Centre

Property Snapshot

Location: Swansea City Centre

Purchase Price: £185,000

Listing: Auction Purchase 28 days from offer accepted

Strategy: HMO Refurbishment

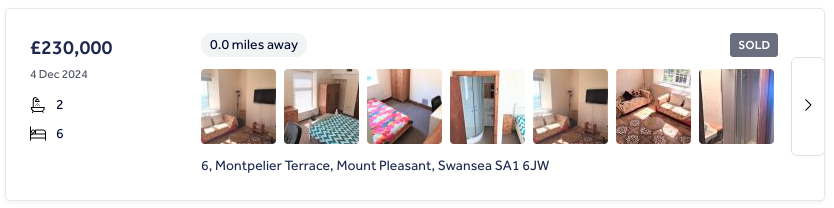

End Value: £365,000

Bedrooms: 6 (all en-suite)

Monthly Rent: £3,450

Expected Monthly Cash flow: £1,274

Annual Gross Rent: £41,400

Annual Net Rent: £15,288

Reserve this deal here for £499. This fee is fully refundable should you decide not to go ahead after completing your due diligence. Full legal pack available on request.

Property Overview

Key Highlights

✅ Multiple exit strategies (HMO or Flip)

✅ Strong rental yield and cash flow potential

✅ High ROI with short payback period

✅ Conservative renovation estimates for fallback

We’ve secured an exceptional opportunity in Swansea—a property with planning and licensing for a 6-bedroom HMO, located in one of Swansea’s most desirable areas, just minutes from the city centre and universities.

The seller, motivated by financial circumstances, agreed to a pre-auction purchase price of £185,000, creating immediate value for the investor. Once the firm offer is accepted, the purchase will be subject to auction terms: a 10% deposit, buyer’s premium, and completion within 28 days.

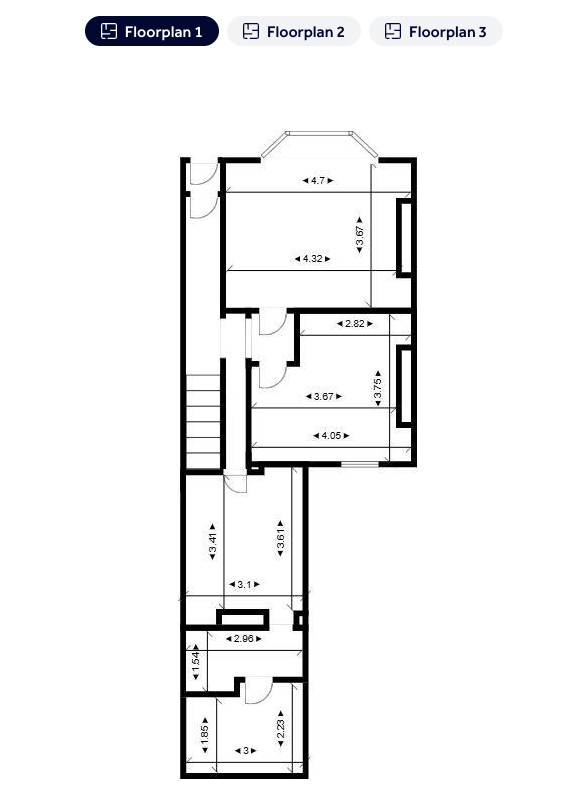

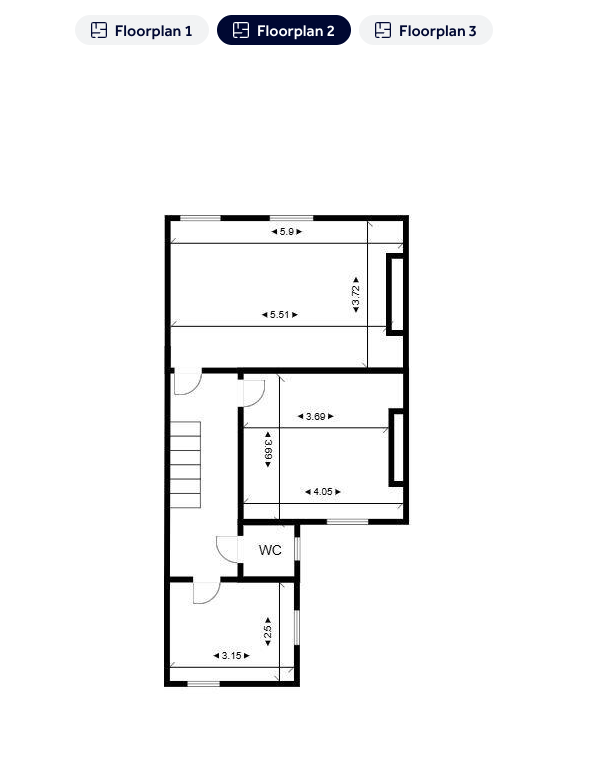

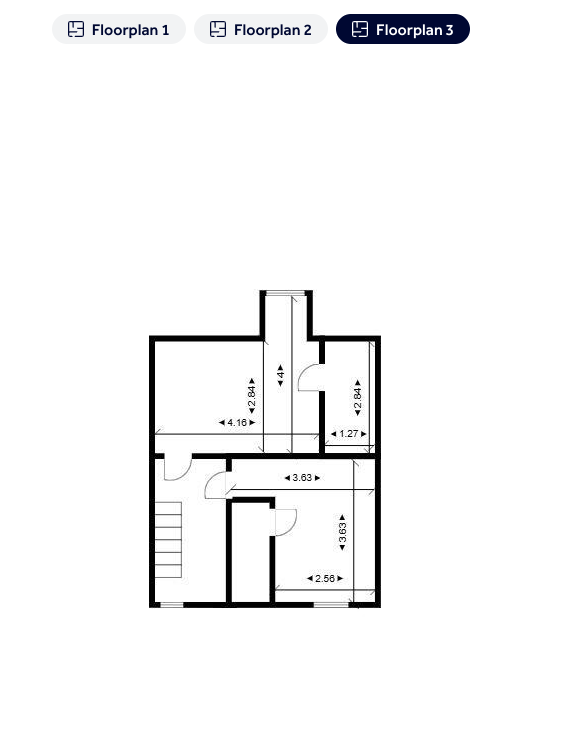

With the existing HMO licence valid until early 2026, the new owner only needs to apply for renewal post-renovation. The property is in good condition and could be re-let as is, but the real potential lies in a strategic upgrade: adding en-suites to bedrooms, repurposing the large middle-floor bathroom, and refreshing the kitchen and utility areas. This transformation positions the property as a premium HMO, driving higher occupancy and rental income.

Estimated renovation costs range from £50,000 for a smart upgrade to £80,000 for a full high-standard conversion, unlocking an end value of £365,000 and strong monthly cash flow. Additional features include a double garage and on-street parking, enhancing tenant appeal.

This is a rare chance to acquire a high-yield asset with multiple exit strategies and exceptional ROI potential.

Costs for HMO Strategy:

Purchase: £185,000

Legals: £1,600

Auction Fees: £4,000

Sourcing Fees: £4,997

Renovation: £80,000

Insurance: £250

Survey: £1,500

Stamp Duty: £9,250

Furnishing: £20,000

Total Investment: £306,597

Finance & Returns:

Monthly rental income: £3450 (This is based on an average of £575 per room per month)

Annual Rental Income: £41,400

LTV (75%): £273,750

Monthly Mortgage (5%): £1,140.63

Agent Management cost (15% rental Income): £517.50

Utilities and running costs (15% rental Income): £517.50

Expected Cash Flow: £1,274/month

Annual cash flow: £15,288

ROI: 84%

Money left in the deal: £32,847

Payback Period: 2 years

Comparable Rooms to Rent in Swansea

Exit Strategy 2: Flip Back to Single Dwelling

Estimated End Value: £270,000–£300,000

Renovation Costs: £30,000 - £50,000 (Schedule of work dependent)

Total Costs: £225,547

Potential Flip Profit: £44,453–£74,453