7 bedroom guest house perfect for a HMO in Torquay, Devon.

7 bedroom guest house perfect for a HMO in Torquay, Devon.

Potential HMO in Torquay - Offer accepted subject to planning! Low Risk!

• 7 Bedroom, Ex-Guest House in a good residential area.

• The property requires planning permission to turn into a 7-bed HMO.

• The property requires a full renovation to meet HMO & fire regulations.

• Purchase Price: Asking- £290,000 subject to planning.

• Reno Estimate: £130,000 including planning.

• End Value: £600,000- exceptionally conservative

• Sourcing Fee: £6,000

Reserve this deal for £199. This is a fully refundable reservation fee should you choose not to go ahead after completing your due diligence.

Investment Opportunity Brief: 38 Bampfylde Road, Torquay, TQ2 5AR

Presented by: Co Source with Tiger Burrows Ltd (Summit Property Group Ltd)

Overview

This is a high-potential property investment opportunity involving the conversion of a former guest house into a 7-bedroom House in Multiple Occupation (HMO) or serviced accommodation. Located in a desirable residential area of Torquay, the property offers strong capital growth and rental yield prospects.

Key Details

Property Type: Ex-Guest House

Bedrooms: 7

Purchase Price: £290,000 (subject to planning)

Renovation Estimate: £130,000 (including planning)

Sourcing Fee: £6,000

Estimated End Value:

£600,000 (shared bathrooms)

Up to £770,000 (with 5 en-suites)

Rental Income Potential:

Up to £5,710/month (gross yield ~8.9%)

Serviced accommodation potential: £164,013 annual revenue (ADR £877, 50% occupancy)

Financial Summary

Total Investment Required: £451,000

Refinance Potential: Up to £525,000 mortgage

Profit on Refinance: Up to £249,000

Monthly Net Profit: £1,393.50

Annual Net Profit: £16,722

Renovation Scope

Full HMO compliance, including fire safety upgrades

Optional en-suite additions to boost rental and resale value

Modernisation of heating, windows, and interiors

Utilisation of garage and storage areas for added value

Market Context

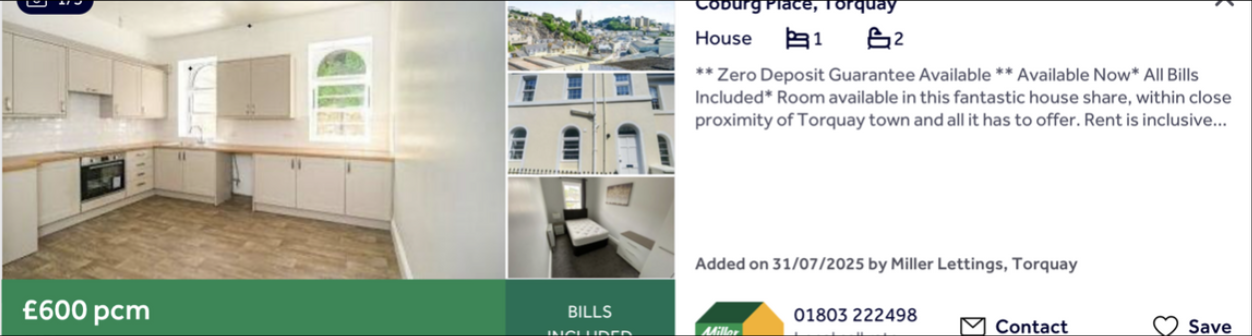

Strong demand for HMO rooms and contractor accommodation in Torquay

Comparable properties show high occupancy and competitive rental rates

Agent valuation supports end value range of £600,000–£750,000

Property Layout & Reconfiguration Potential

The property spans approximately 2,120 square feet, offering substantial flexibility for layout optimization. There are two main configuration options:

Option 1: Convert the property into 5 en-suite bedrooms and 2 double bedrooms with shared bathrooms.

Option 2: Retain the existing structure as 7 double bedrooms, all sharing communal bathrooms.

Additional layout enhancement opportunities include:

The top-floor toilet can be easily converted into a shower room, improving functionality.

The smallest bedroom on the first floor could be reconfigured into either one large bathroom or two compact shower rooms.

On the ground floor, the second reception room adjacent to the shower room presents an ideal space to be transformed into an en-suite bedroom.

These modifications would significantly increase both the rental appeal and the end value of the property.

Detailed Financial Analysis for 7 bedrooms and Shared Bathrooms

Price Offered: £290,000.00 – The price you have agreed to pay for the property

Mortgage %: 75.00% – Typical BTL mortgage is 75% - Typical Bridging Finance is 60%

Mortgage: £217,500.00 – This is the amount a mortgage company would be willing to lend

Deposit: £72,500.00 – The deposit that would be required to be funded by you

Stamp Duty: £19,000.00 – Please go to the government’s website to calculate Stamp Duty – www.tax.service.gov.uk/calculate-stamp-duty-land-tax

Legals: £2,000.00

Total Refurb Costs: £110,000.00 – Best obtained via a builder’s quote

Furniture/Setup cost: £10,000.00 – Cost to furnish and stage the property

Total Money In: £431,000.00 – Total money required to fund the deal

End Value

End Value: £600,000.00 – What will the value of the property be after you’ve refurbished it

New Mortgage Amount: £450,000.00 – New mortgage amount (assuming 75% BTL)

Money Pulled Out: £150,000.00 – Money pulled out after refinancing (assuming 75% BTL)

Profit: £169,000.00 – How much profit you will make (Please note: if refinancing, much or all of this will be left in the deal)

Money Left In: -£19,000.00 – How much money will be left in the deal, assuming you refinance on a 75% BTL mortgage

Income Gross

Monthly Rent: £4,800.00 – Average nightly rate, use online comparables

Number of rooms: Number of rooms in the property being rented (If renting the whole property: 1 room)

Occupancy Rate: % – Average occupancy rate, use online comparables

Total Income Per Month: £0.00 – Gross income per month

Total Income Per Annum: £0.00 – Gross income per annum

Expenses

Mortgage: 6.00% – £2,250.00 – Mortgage payments post refinance

Management: 10.00% – £225.00

Maintenance: 10.00% – £225.00

Council Tax: £194.00 – Check the council website

Utility bills: £400.00 – Includes Gas, Electricity, Water, Broadband, TV License, Insurance (and cleaning if paying above what guest will pay)

Total Expenses: £3,294.00 – Total monthly expenses

Cashflow

Monthly income: £4,800.00 – Total monthly income

Monthly Expenses: £3,294.00 – Total monthly expenses

Monthly Profit: £1,506.00 – Total monthly profit after expenses

Annually Profit: £18,072.00 – Total annual profit after expenses

Detailed Financial Analysis – End Value for 7 bedrooms, x5 en-suite bathrooms

Price Offered: £290,000.00 – The price you have agreed to pay for the property

Mortgage %: 75.00% – Typical BTL mortgage is 75% - Typical Bridging Finance is 60%

Mortgage: £217,500.00 – This is the amount a mortgage company would be willing to lend

Deposit: £72,500.00 – The deposit that would be required to be funded by you

Stamp Duty: £19,000.00 – Please go to the government’s website to calculate Stamp Duty – www.tax.service.gov.uk/calculate-stamp-duty-land-tax

Legals: £2,000.00 – If unsure allow £3k

Total Refurb Costs: £130,000.00 – Best obtained via a builder’s quote

Furniture/Setup cost: £10,000.00 – Cost to furnish and stage the property

Total Money In: £451,000.00 – Total money required to fund the deal

End Value

End Value: £700,000.00 – What will the value of the property be after you’ve refurbished it

New Mortgage Amount: £525,000.00 – New mortgage amount (assuming 75% BTL)

Money Pulled Out: £175,000.00 – Money pulled out after refinancing (assuming 75% BTL)

Profit: £249,000.00 – How much profit you will make (Please note: if refinancing, much or all of this will be left in the deal)

Money Left In: -£74,000.00 – How much money will be left in the deal assuming you refinance on a 75% BTL mortgage

Income Gross

Monthly Rent: £5,100.00 – Average nightly rate, use online comparables

Number of rooms: Number of rooms in the property being rented (If renting the whole property: 1 room)

Occupancy Rate: % – Average occupancy rate, use online comparables

Total Income Per Month: £0.00 – Gross income per month

Total Income Per Annum: £0.00 – Gross income per annum

Expenses

Mortgage: 6.00% – £2,625.00 – Mortgage payments post refinance

Management: 10.00% – £225.00

Maintenance: 10.00% – £262.50

Council Tax: £194.00 – Check the council website

Utility bills: £400.00 – Includes Gas, Electricity, Water, Broadband, TV License, Insurance (and cleaning if paying above what guest will pay)

Total Expenses: £3,706.50 – Total monthly expenses

Cashflow

Monthly income: £5,100.00 – Total monthly income

Monthly Expenses: £3,706.50 – Total monthly expenses

Monthly Profit: £1,393.50 – Total monthly profit after expenses

Annually Profit: £16,722.00 – Total annual profit after expenses

MARKET COMPARABLES

All HMO rooms in the close area.

Rightmove: 4 of the 7 rooms available are let.

SpareRoom: 113 people with profiles looking for rooms.

Local Agents Review:

Serviced Accommodation Potential

There is a strong contractor market in Torquay, making this property ideal for use as serviced accommodation for contractor housing.

For 7 guests sharing bathrooms, the estimated nightly rate is £877, offering significant revenue potential.

Renovation Costings

Estimated works of £130,000 are required to renovate the property to full HMO specification.

The decision to include en-suites will impact the final cost.

A detailed and accurate estimate can be provided once the floor plan and finishes (tiling, flooring, kitchen, etc.) are confirmed.

The property has mains gas but is currently electrically heated; all systems are fairly modern.

As it was previously a guest house, an old fire system remains in place and will need upgrading.

Windows are generally in good condition but may require replacement to comply with fire regulations and conservation area requirements.

There is a double garage suitable for parking and a storage area that can be utilized for bikes and bins.