A great BTL opportunity in Neath, South Wales.

A great BTL opportunity in Neath, South Wales.

This property offers an excellent entry point into the Buy-to-Let market. With a simple renovation required, it provides strong cash flow and a reliable return on investment. It’s ideal for a straightforward buy, refurbish, and refinance approach, with the potential to achieve around £12,000 profit within six months from start to finish.

Property Details:

Purchase Price: £75,000

Renovation Costs: £30,000

Estimated End Value: £125,000

Investment Potential:

Estimated Flip Profit: £7,500

BTL Cash Flow: £309 per month

Reserve this deal for £299. This is a fully refundable reservation fee should you choose not to go ahead after completing your due diligence.

Property Investment Opportunity: Neath, SA11

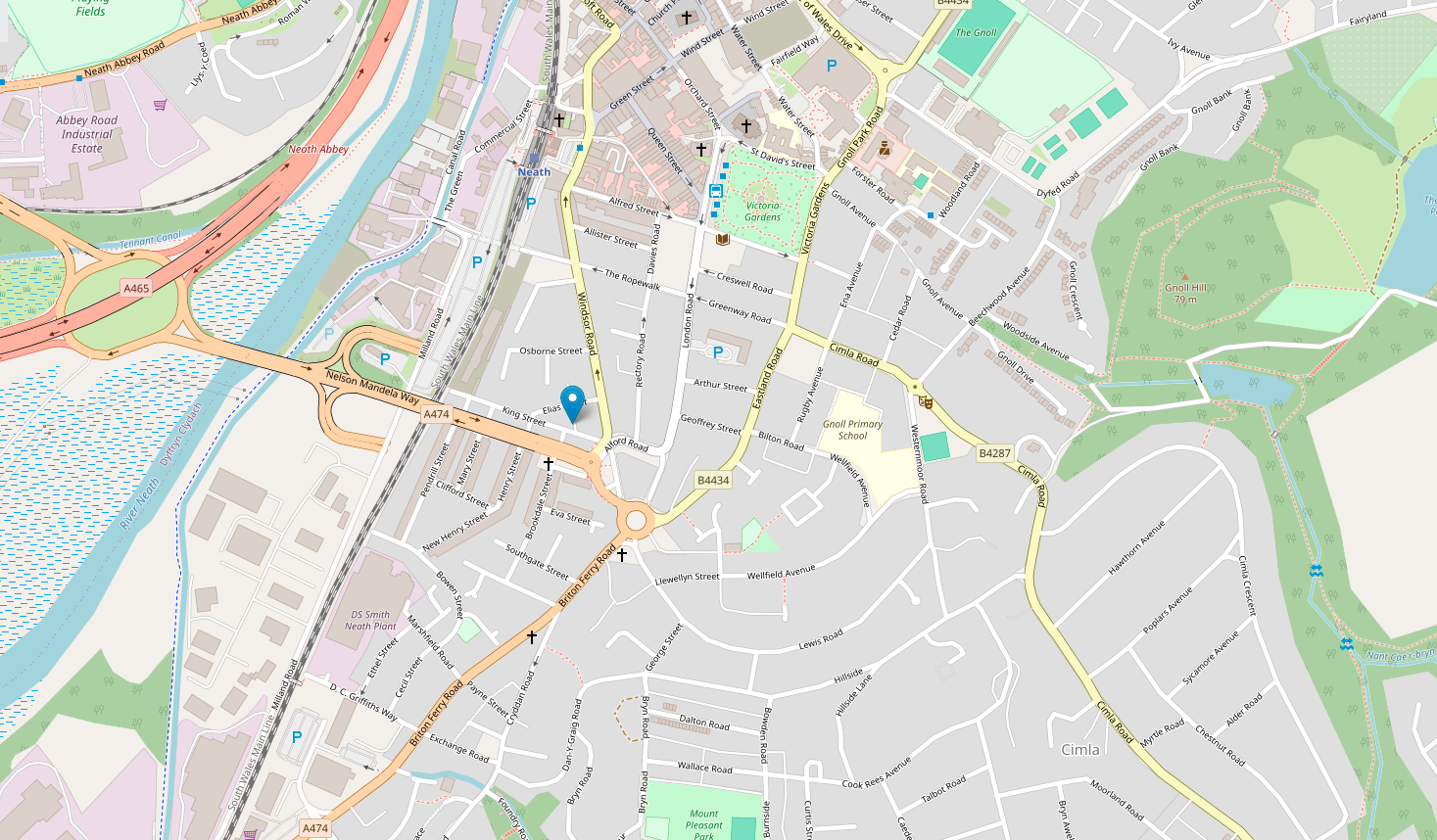

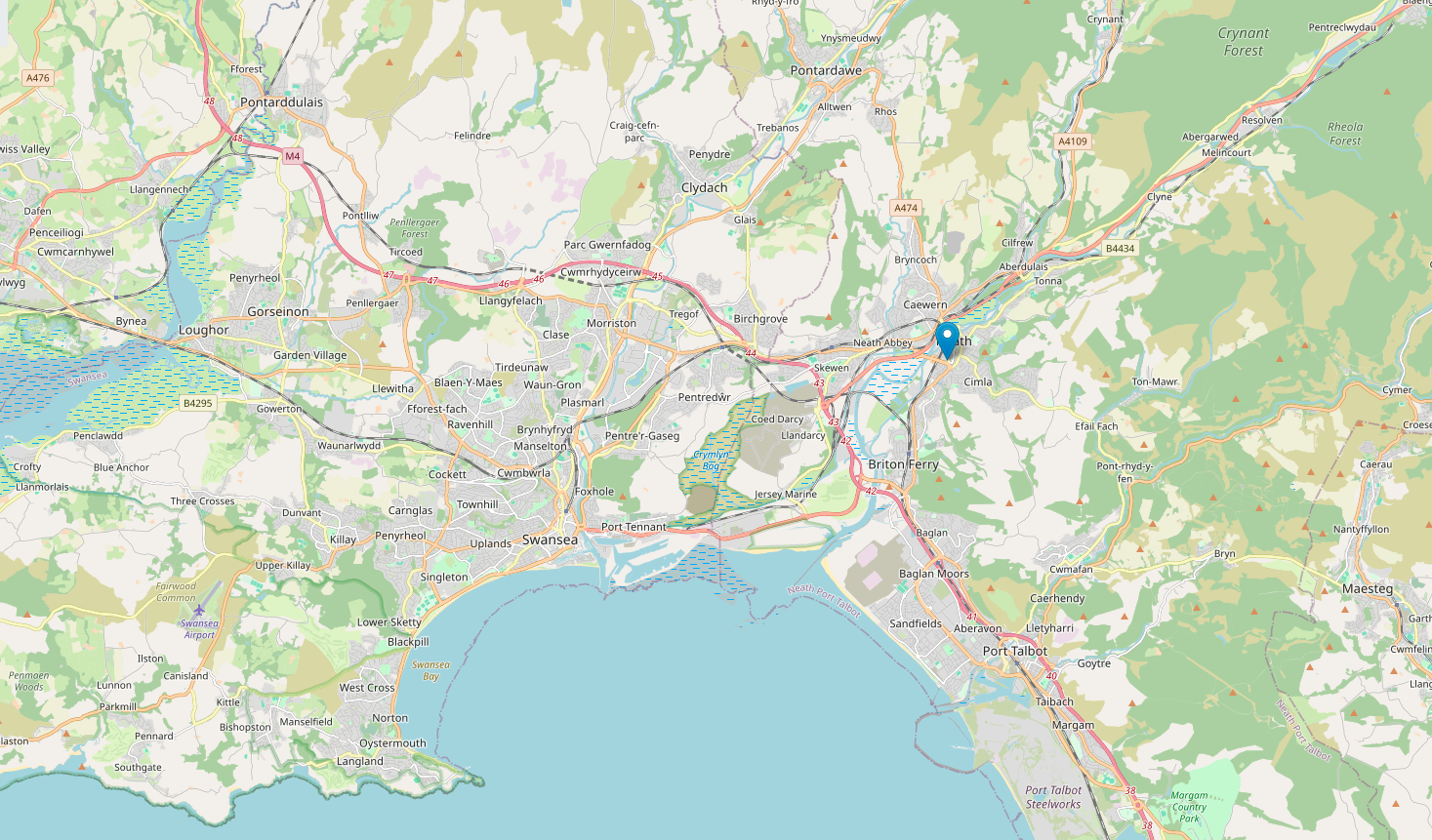

This property represents a strong Buy-to-Let opportunity in a desirable part of Neath. Located within walking distance of the town centre, it offers excellent potential for investors seeking reliable, income-generating assets. Neath is a well-connected and lively town with a strong community and plenty of local amenities. Shops, cafes, and leisure facilities are all close by, while nearby schools and transport links make it an appealing choice for both families and working professionals.

With light renovation, the property’s end value is expected to reach £125,000. The achievable rental income of £800 to £900 per month provides an attractive yield and consistent cash flow. Property prices in the area have remained stable, offering long-term security for investors.

Rental demand in Neath continues to be strong, supported by a steady mix of professionals, families, and tenants receiving housing support. The town’s proximity to major employment hubs and local colleges further strengthens its appeal.

Comparable property sales in the area confirm the projected end value, giving confidence in both the capital growth and rental potential of this investment.

Number of Bedrooms (current): 2

Is there potential to add a bedroom?: No

Reception Rooms: 1

Bathrooms/shower-rooms: 1

Property Asking Price: £100,000 then reduced to £80,000

Agreed Sale Price: £75,000

Fair Market Value (DUV): £120,000 to £130,000

Comparable 1: Sold £125,000: https://www.rightmove.co.uk/house-prices/details/d601bec8-4ca5-438b-9090-09d0523b82dc

Comparable 2: Sold £118,000: https://www.rightmove.co.uk/house-prices/details/8102365b-27c7-4f92-b465-472db656655b

Comparable 3: Sold £122,000: https://www.rightmove.co.uk/house-prices/details/c9858271-9201-47c1-8628-167a53e226cf

Comparable 4: Sold £122,500: https://www.rightmove.co.uk/house-prices/details/cf5f98dc-3324-4d06-95ba-5a226bb6f31f

Market Status: Sale Secured by Sourcing Agent

Why is the property being sold?: Distressed Seller

Is the property in a lettable condition? Yes

Is the sale price negotiable?: No

Property Type: House

Freehold or Leasehold: Freehold

Is the property part of portfolio?: Unknown

Exit Strategy 1: BTL

Exit Strategy 2: Cash Purchase Flip (or bridge)

Exit Strategy 3: Capital Growth

Potential Target Demographic: Families and young professionals or social housing.

Refurbishments Required: Total Budget: £30,000

Duration: 8 Weeks

Week 1: Preparation and Demolition

Day 1-2: Rip out existing fixtures, fittings, and materials, including old kitchen and bathroom.

Day 3-4: Waste removal from the property; ensure proper disposal of debris.

Day 5: Inspection of existing electrical wiring and plumbing systems.

Week 2: Electrical and Plumbing Works

Day 6-7: Rewire the property, ensuring all electrical systems meet safety standards.

Day 8-10: Service the boiler and issue the necessary certification. Check all plumbing for issues.

Week 3: Structural and Preparation Works

Day 11-12: Complete plumbing installation for the new kitchen and bathroom.

Day 13-14: Install boarding for walls and ceilings; prepare surfaces for plastering.

Week 4: Plastering and Woodwork

Day 15-17: Plastering of walls and ceilings for a smooth finish.

Day 18-20: Woodwork and trimming installation, including skirting boards and architraves.

Week 5: Kitchen and Bathroom Installations

Day 21-23: Supply and fit new kitchen units, countertops, and appliances.

Day 24-26: Supply and fit new bathroom fixtures, including tub, sink, and toilet.

Week 6: Roofing and Windows

Day 27-28: Install a new flat roof over the kitchen, ensuring proper insulation and waterproofing.

Week 7: Finishing Touches

Day 31-33: Painting and decorating throughout the property, focusing on walls, ceilings, and woodwork.

Day 34: Final inspections to ensure all work meets quality standards.

Week 8: Flooring and Final Cleanup

Day 35-36: Install new carpets and flooring in all living spaces.

Day 37-40: Final cleanup of the property, ensuring it is ready for tenants or buyers.

Estimated Refurbishment Costs: £30,000 (Tiger Burrows Projects Ltd offers hands off project management solutions for £3000)

BTL Figures:

Purchase Price: £75,000

Refurb Costs: £30,000

Legal Costs: £1600

Stamp Duty: £3750

Survey: £450

Tiger Burrows Consultation Fee's: £2997

Estimated Rental Income: £850

New Mortgage (5%): £390.63

Stress Test Mortgage (6%): £468.75

Estate Agent Rates: £85

MOE: £85

Cash Flow Most Likely: £309.38

Cash Flow Stress Test: £231.25

Flip Figures:

Purchase Price: £75,000

Refurb Costs: £30,000

Entry Legal Costs: £1600

Exit Legal Costs: £1000

Stamp Duty: £3750

Survey Costs: £450

Tiger Burrows Consultation Fee: £2997

Estimated 6 months bills costs: £750

Estate Agent Selling Fees: £1950

Total Costs for investor: £117,497

Re-sale price (DUV): £125,000

Estimated Flip Profit: £7,503