Llanelli for £18,000 flip profit or keep as income generating asset!

Llanelli for £18,000 flip profit or keep as income generating asset!

Property Details:

Purchase Price: £97,668

Renovation Costs - £30,000

Estimated End Value: £160,000

Investment Potential:

Estimated Flip Profit: £18,000

BTL Cash Flow: £180 per month

Reserve this deal here for £199. This fee is fully refundable should you decide not to proceed after completing your due diligence.

Property Overview for 59 Pembrey Road, SA15 3BL (2025)

Overview: This 101 square metre Mid-Terrace property features three bedrooms, one bathroom, and two reception rooms. Situated in a sought-after area, it presents an exceptional opportunity for investors looking to capitalise on either a flip or a rental strategy.

Investment Potential: Investing in this property is advantageous due to its potential as an income-generating asset. The local rental demand remains strong, driven by the proximity to essential amenities and transport links. The estimated rental income of approximately £850 per month provides a solid cash flow. With refurbishment, the potential return on investment (ROI) exceeds 11.7%, making it a lucrative prospect.

Area Highlights: Located in Llanelli, the property benefits from excellent transport links, including easy access to the M4 motorway. This connectivity is ideal for professionals commuting to nearby cities. Families will appreciate the close proximity to schools, parks, and healthcare facilities, enhancing the area's appeal for long-term tenants.

Local market statistics indicate stable property values, with a recent average sale price of around £161,625 for comparable properties. This stability, coupled with ongoing regeneration schemes in the area, supports the projected end value of £160,000 for this property.

Demographic Appeal: The area attracts a diverse range of tenants, from young professionals to families and individuals on income support. The availability of affordable housing options and local job opportunities further drives demand. Investors can expect a reliable tenant pool and low vacancy rates, ensuring consistent rental income.

Comparable Sales: Recent sales in the vicinity reinforce the sound investment proposition. Properties sold within a half-mile radius have achieved prices up to £175,000, validating the investment's end value. Such comparables provide confidence in the market's resilience and future growth potential.

Conclusion: With its blend of space, location, and investment potential, 59 Pembrey Road is an exceptional opportunity for savvy investors. The property's ability to be refurbished for added value, coupled with strong rental demand and stable market conditions, positions it as a prime candidate for both flipping and long-term rental strategies. Take advantage of this modern method of auction and secure a strong below-market-value deal today.

Estimated Done Up Value (DUV): Between £155K to £175K.Refinancing @ 75% Loan To Value (LTV)Capital Left in Project (+/-): £160,000

Break Even Point (BEP): 8 years and 6 months at 5.00% interest only rate & rental @ £850.Return On Investment (ROI): About 26.9% (BTS) and 11.7% (BTL).

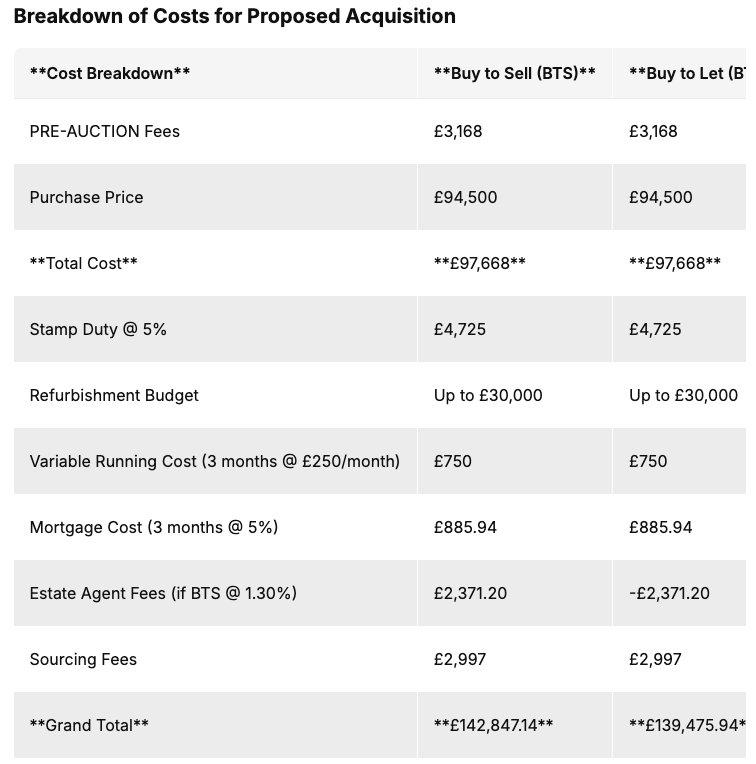

Total Investment Required

Buy-To-Sell (BTS): £142,847.14

Buy-To-Let (BTL): £139,475.94

Exit Strategies

1. Buy-To-Let (BTL)

Rental at £850/month.

Cashflow @ 5.00% = £180/month

ROI: 11.7%

BEP: 8 years 6 months

2. Buy-To-Sell (BTS)

Resale value: £155,000 to £175,000

Estimated pre-tax profit: about £18,000

ROI: 26.9%

Comparable Market Analysis (CMA) Report

Properties Sold:

£152,888: 57 Gilbert Crescent, SA15 3RB

£155,000: 17 Chapman Street, SA15 3EB

£172,000: 21 Coldstream Street, SA15 3RG

Properties For Sale:

£174,950: 6 New Road, SA15 3DW

£169,995: 49 Albert Street, SA15 2SY

For Let Properties

£795: Gilbert Crescent, SA15 3RB

£840: Stryd Bennett, SA15 4DQ

£995: Pembrey Road, SA15 3BP

Disclaimer: Tiger Burrows (TB) conducts extensive due diligence to deliver successful deals to clients. However, property investing carries risks such as market fluctuations. TB cannot be held responsible for any market changes or unmet expectations. Investors are advised to conduct their due diligence and seek external advice.